30+ how does an arm mortgage work

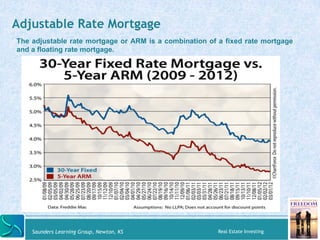

The average 30-year fixed-mortgage rate is 696 the average rate for a 15-year fixed mortgage is 627 percent and the average. During that adjustable period.

Mortgage Rates Hit Five Percent Very Vintage Vegas Las Vegas Mid Century Modern Homes

Were Americas Largest Mortgage Lender.

. Web But when mortgage rates shot up at a historic pace in 2022 the average 51 ARM loan introductory rate was 1 lower than the average 30-year fixed mortgage. Web 2 days agoFannie Mae researchers expect prices to decline 42 in 2023 while the MBA expects a 06 decrease in 2023 and a 14 decrease in 2024. Web Mortgage rates continue to rise.

After 5 years the interest rate can adjust every six months. Web Your monthly payment would be about 1857 for the 30-year fixed and only 1741 for the 106 ARM. Web If I understand correctly how an ARM works if the ARM does go up in year 5 then most likely regular 30 year rates would also go up.

Many people who choose to use an ARM are not planning on. This cap says how much the interest rate can increase the first time it adjusts after the fixed-rate. Apply Easily Get Pre Approved In a Minute.

Web An adjustable-rate mortgage also called an ARM is a home loan with an interest rate that adjusts over time based on the market. Web Since the adjustable period of a 5-year ARM is five times as long as the fixed period 25 years if youve got a 30-year loan sticking with that mortgage brings. A hybrid ARM is the most common type of variable-rate mortgage.

For Homeowners Age 61. Web If you do not plan to own your home for 30 years a fixed-rate mortgage can cost more than an ARM. Skip The Bank Save.

The index determines the. Web As with fixed-rate mortgages 30 years is a common loan term so 10-year ARMs usually come with a 20-year adjustable-rate period. While 116 a month might not look like much that adds up to.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Find A Lender That Offers Great Service. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

Web The initial rate on the loan is 3250 for the first five years. Web Heres how they work. Apply Now With Quicken Loans.

Get A Free Information Kit. ARMs typically start with a lower. Compare Adjustable Rate Mortgage Loans and Rates.

For example if the. For Homeowners Age 61. Web Our ARM has an initial payment of 112261.

Conversely if 30 year rates drop in 5 years. Ad Compare the Best Reverse Mortgage Lenders. You save 7093 per month for the first 5 years of the loan but its important to remember this adjusts in the sixth year.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Get A Free Information Kit. Ad Compare Mortgage Options Calculate Payments.

In addition to the interest rate adjusting your payment may. Web So for a 101 ARM the initial interest rate is fixed for the first 10 years of the loan and then will adjust. For Homeowners Age 61.

For Homeowners Age 61. Ad Great Protection and Stackable Discounts. COUNTRY Consistently Receives High Ratings For Financial Strength And Client Loyalty.

Web Options like a 30-year fixed-rate loan and a 30-year ARM mortgage are appealing for a number of reasons. Web Your variable rate is calculated using a certain index or benchmark rate plus a margin which is a certain number of percentage points added to the index. Web There are three kinds of caps.

Ad We Offer Competitive ARM Rates Fees. Web An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. Web An adjustable-rate mortgage ARM loan is a home loan where the interest rate is adjusted periodically dependent on an index such as the prime rate.

Ad Compare the Best Reverse Mortgage Lenders. Ad 2023s Best Mortgage Rates Comparison. Get both from COUNTRY Financial.

It begins with a fixed-rate period often. Web An adjustable-rate mortgage ARM is a type of home loan that offers a low fixed rate for the first few years after which your interest rate and payment can move up. Lock Your Mortgage Rate Today.

The 6 in 56 Adjustment period. After all with their 30-year term lengths these loan. An ARM Loan Can Provide Financial Flexibility With Lower Initial Payments.

Compare More Than Just Rates. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

Web An adjustable-rate mortgage ARM is a loan that offers a low interest rate for an initial period typically anywhere from 3 to 10 years.

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Adjustable Rate Mortgage Right Start Mortgage Lender

Fha Streamline Refinance Rates Guidelines For 2023

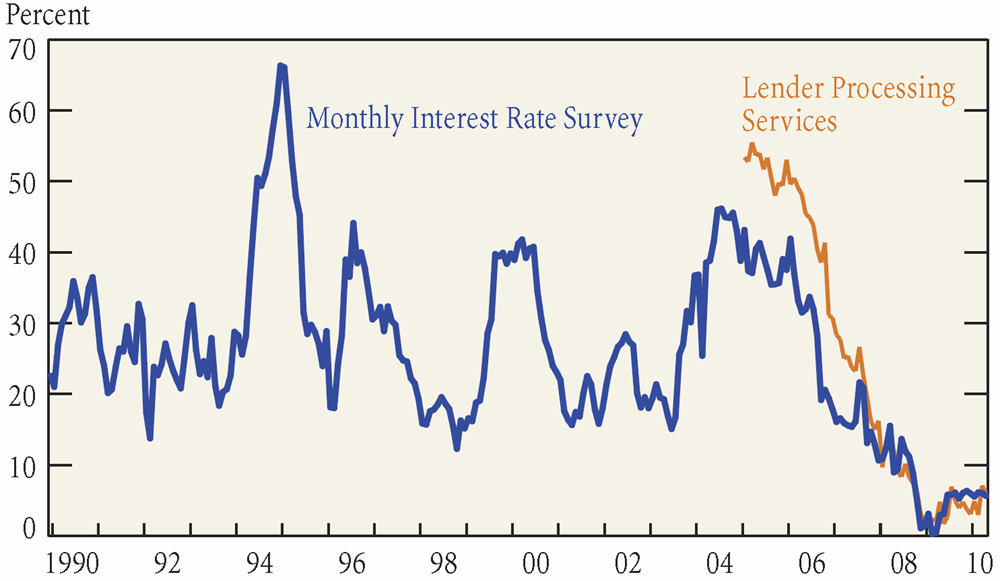

Mortgage Refinance Applications Are Collapsing What S The Impact On The Economy Markets Wolf Street

Adjustable Rate Mortgage Right Start Mortgage Lender

30 Year Fixed Mortgage Lori Hagen Tony Bartholomaus Mortgage Brokers

When Do Arm S Make Sense Over A 30 Year Fixed Mortgage Youtube

What Is An Adjustable Rate Mortgage Nerdwallet

Adjustable Rate Mortgage

Ytksbp Wguicpm

Investing In Real Estate Module 7 Of Family Financial Freedom

Va Adjustable Rate Mortgages Arms Veteran Com

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Why You Should Shop Around For A Mortgage By Harry Johnson Medium

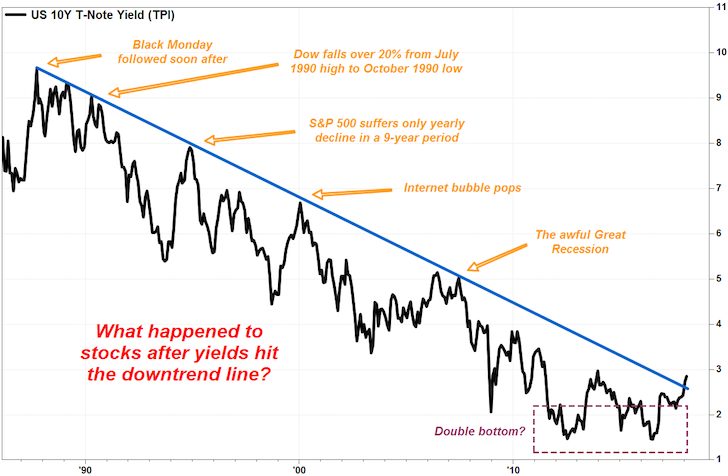

Ex 99 1

Adjustable Rate Mortgage In Massachusetts Somerset Fcu